We’ve been lied to. Plain and simple.

They’ve told us to work hard, drive a two-hour commute to work, put some money in a 401K and everything will be rosy for retirement. It’s a lie. Working harder over longer hours is not the answer and putting money in a 401K will lead to mediocre results. After all the average 401K at retirement age is $70,000! Can you live off of that for the rest of your life? Of course not.

Everything changed for me when I discovered what I call The Freedom Number. The Freedom Number is the foundation of building legacy wealth For you and your family. Without it you don’t know where you’re going or where you’ve been. It’s the single most important guide post along your journey to financial freedom.

Before we get to the formula it’s important to understand the foundation of the formula. And it all starts with owning rental real estate. In my opinion rental real estate is the single best investment you can make. I have yet to find a better passive income model than owning cash flowing rental properties in some of America’s most affordable areas. Rental real estate is stable, it’s predictable, it’s passive, and the stock market can’t hold a candle to it.

When I learned this simple Freedom Number formula it changed my life. Because for years I threw around arbitrary numbers, like “I want to be a millionaire,” without any idea as to “why.” When you run this simple Freedom Number formula you will be shocked to find that you don’t need to make a million dollars at all. True financial freedom is quickly attainable with passive income generated through real estate investing.

I also guarantee that you’ll be shocked at just how few rental properties it’ll take for you to reach Freedom. I know I was. So without further ado, here’s my Freedom Number formula.

Step 1:

Open your bank accounts and look over the last 6 months of your expenses.

Expenses are what it takes to run your family every month. They may looking like this: Electric bill, cable bill, groceries, gas for the car, Netflix subscription, tuition, taxes, mortgage or rent, a few dinners out, a movie. Don’t leave anything out and don’t cut corners. If you’re reading this during the holiday season then you’ll want to leave that out. Skip the holiday’s because they’ll throw everything out of whack.

Take those six months worth of expenses and find the average of those months. Let’s say for the sake of argument that your number is $4,500 a month.

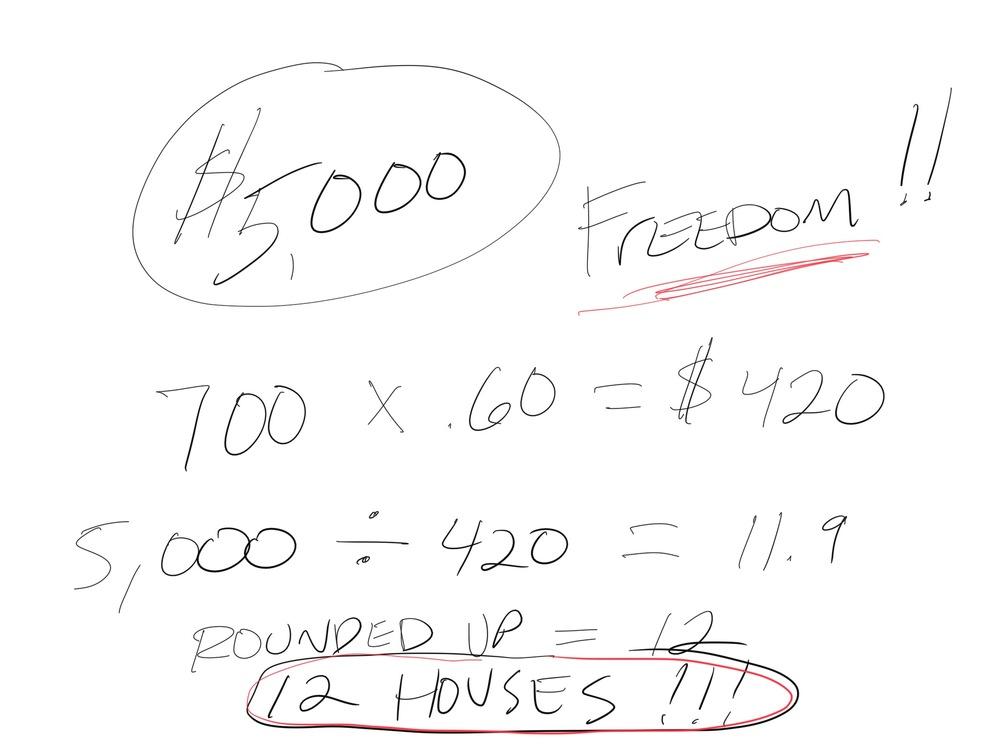

Great. Now I want you to pad it a little. So add about 10% just to give you some extra Freedom. In this example 10% of $4,500 is $450… just round it up so we have an even $5,000.

So $5,000 is our Freedom Number for this example. If we had an additional $5,000 a month coming into our house we’d have everything covered. We would have achieved financial freedom. Doesn’t sound like a lot does it? It’s not, and you don’t need to be a millionaire to achieve it.

Step 2:

The next step is the fun part. This is the part where we figure out how many rental properties it would take to cover our $5,000. Most of the rental properties that I fix and sell to my investors, or keep for myself, are 3 bedroom 1 bath houses in states like Indiana, Mississippi, Pennsylvania, Etc. And most of them rent between $600-$900 a month. Each of these houses cost roughly $29-40,000 after they’ve been rehabbed. But for now we’re only concerned with the rent. For the sake of this example lets use an easy rental average of $700 per month.

Step 3:

Then I like to be super conservative in my estimations so I take $700 and I want to account for an additional 40% for vacancies and repairs (both of which are rare especially since we just renovated the house). 700 x .60 = $420. In a worst case scenario we’d be making $420 per month on this house. Again, I do it to be conservative and safe.

Step 4:

Now here’s the magic moment to find our Freedom Number. We now simply take our expenses number of $5,000 and divide it by $420. We get 11.9. let’s round that up to 12.

12 properties cash flowing $700 (minus repairs, vacancies, etc.) or $420 a month is all it would take for us to achieve our Freedom Number. Isn’t that remarkable?

Recap:

To recap: Add up your monthly expenses and pad it by 10%. Then take the average single family rental $700 X .6 (vacancy and repairs) = $420. Take your monthly expenses and divide that by 420. You’re left with 12. It would take simply 12 rental properties to achieve financial freedom.

If you want a free PDF Version of this Freedom Number that you can print out click the button below. If you’re ready to take action right now to build passive income for you and your family, to cut down on your commute to work, to spend more time with your family and less time worrying about money. Then book a call with our team today. Our consultation is totally free. We’ll spend 30 minutes on the phone helping you to start taking action to build passive income talking through real estate investing. Book a call today by signing up here and claim your PDF copy of our Freedom Number.